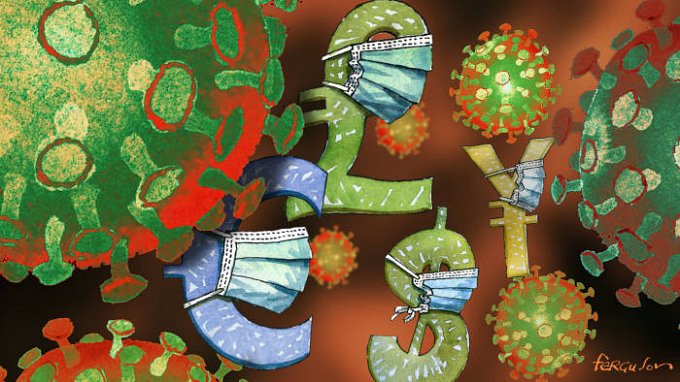

The euro gained against on Monday as investors shrugged off worries that rising coronavirus infections in parts of Europe and the United States over the weekend could scupper a quick economic rebound. Torn between record stimulus and growing fears of a second wave of infections, stocks have been moving sideways in recent weeks after rising more than 40% from March lows on hopes the worst of the pandemic was over.

Sterling rose against dollar, recovering from a three-week low during Asian trading, helped by a weaker dollar, hopes of a Brexit trade deal and expectations of better economic data. Britain has until the end of the year to sign a new trade agreement with the European Union, when a transition period following its exit from the bloc comes to an end. Although much remains to be discussed, both parties have signaled progress The dollar dipped against the Japanese yen as investors edged into perceived safe-haven assets after the World Health Organization reported a record global increase in COVID-19 cases. New U.S. cases on Saturday hit the highest since early May, while the WHO reported on Sunday total cases rose by 183,020 in a 24-hour period. Fears of a second wave have also spurred safe-haven demand.

It’s a busy day ahead on the Eurozone economic calendar. Key stats include June’s prelim private sector PMIs from France, Germany, and the Eurozone. The markets will be looking for a bounce from May levels to support a speedier than expected economic recovery, fueled by fiscal and monetary support. While the headline figures will be key, we can expect the services PMIs to be the key driver. Expect employment and new business to garner plenty of attention.